The Buying Process

Step One - Finding the "right" property:

Any business purchase starts with serious research. Before making a buying decision you may have visited web sites, attended seminars, spoken to your professional advisors and spent time with a specialist Management Rights agent before determining that Management Rights is your sort of business. You will have drawn up a “wish list”, looked at various properties and feel that you understand the fundamentals of the industry.

Share your aspirations with your Management Rights agent as agencies specialising in Management Rights will have a wide variety of properties within your price range to show you.

At this stage it is advisable to take advantage of the initial complimentary interviews offered by Management Rights financiers, accountants and solicitors. If you are intending to borrow funds to assist with your purchase, banks and brokers specialising in the industry will quantify your spending power so that you are in a position to act quickly when the right opportunity occurs.

Specialist accountants and solicitors will provide advice on business structure and recommend purchasing entities for both the Manager’s unit and the Management Rights business. It is important to get this right on the contractual documentation as, if this is changed, there could be additional stamp duties applied. Your purchasing entity may be a sole trader, partnership, company, family trust or other entity and your accountant will provide valuable recommendations on successful on-going business and tax accounting strategies relevant to your circumstances.

You will value the support of an experienced agent specialising in Management Rights sales. The team at CBMR have years of personal experience in the industry and will willingly share their knowledge with you.

Step Two - Going to Contract:

Once you have decided on the best business to acquire, your agent will ask you to formalise your offer by completing a form known as a Letter of Intent. This written offer is presented to the Management Rights seller and, once the price and terms of your offer have been agreed, you will go to Contract.

In Queensland the appropriate residential and business contracts can be prepared by your agent and forwarded to both solicitors for approval. In NSW your agent will present the required information to the seller’s solicitor who will prepare the Contracts.

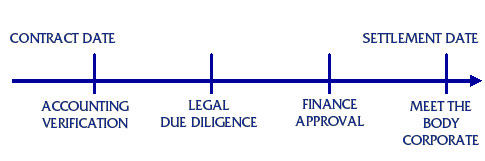

When all parties have signed the agreed Contracts, a Contract Date is determined, you pay an initial deposit (typically $5,000 for each Contract) and the clock starts ticking.

Unlike conventional residential real estate contracts, the purchasing of a Management Rights business involves much more in-depth research and verification and your Contracts will typically contain the following conditions proposed on your behalf to safeguard your interests:

- Pest and building inspection – usually within 10 to 14 days after contract date.

- Accounting due diligence generally can be achieved within 21 days. It is advisable to initiate these verifications promptly, as your financier will require the profit verification report from your accountant before approving finance.

- Legal due diligence is normally completed 15 days after financial due diligence.

- Finance approval – hopefully, you will have a reasonable understanding of your position following your initial discussions with your financier. Formal approval of finance typically takes approximately 45 - 60 days after the contract date.

- Payment of the deposit balance usually occurs when the above conditions have been satisfied.

Step Three: Your Resident Letting Agents License (Queensland):

If you have not already done so, contact an accredited Training Provider and make arrangements to complete the Resident Managers’ course. You can elect either classroom training conducted in house over a five day period or an internet or distance learning course you can complete in your own time. You need to ensure that you have given yourself enough time to obtain your institution attainment certificate which must be presented to the relevant Office of Fair Trading in order that you are licensed prior to commencing your business operation.

The Office of Fair Trading will also require confirmation of the assignment of the Letting Agreement from the Body Corporate prior to final approval of your Licence.

The Body Corporate committee will want to meet you prior to the assignment being granted. You will need to compile a Curriculum Vitae (CV) and personal and business references for the Seller to present to the committee when this meeting is requested on your behalf.

The Body Corporate has up to 30 days to confirm an interview date and delays in presenting your CV and references could cause unnecessary delays in the settlement process.

Step Four: - Building and Pest Inspections:

Like any real estate purchase it isimportant to make contractual provision for building and pest inspections on the real estate purchase. We would advise that you attend these inspections with your agent so that you can obtain “on the spot” clarification of any matters raised. It is advisable to schedule these inspections prior to the more comprehensive accounting and legal due diligence.

Step Five - Accounting and Legal Due Diligence:

It is vitally important to choose Management Rights specialists for each step in the due diligence process as this will save you time, emotional stress and money. Getting it right from the start is the only way to ensure your purchase will be successful.

The professional fees associated with a Management Rights purchase can be substantial and it is therefore important to choose your professional advisors carefully. Our agent will be able to make suggestions for you, or refer to our list of Industry Service Providers on our website.

Accounting Verification

It is important that your chosen accountant has Management Rights experience as the accounting verification report prepared must be comprehensive enough and sufficient to be accepted by your financier. It is usually completed within fourteen days from Contract Date, sometimes twenty-one days.

The written report will provide a financial “snapshot” of the business, account for any industry anomalies and pose questions about any revenue items that may not be sustainable. Your Accountant will normally attend at the premises of the business you are purchasing to:

- Verify the stated net profit of the business for the period nominated on the business Contract (the most recent twelve month period prior to the Contract Date)

- Verify the number of units in the Letting Pool and check the validity and assignment provisions of the PAMD20a Agent Letting Agreements

- Review the Trust Account records held by the Seller

- Other important factors such as occupancy and rental or tarrifs, expenses specific to the industry

Once you commence your business operation you will be required by law to have your business Trust Account audited three times per year. An experienced Management Rights accountant will be able to offer these services to you.

Legal Due Diligence:

Your Solicitor has a pivotal role to play in the Management Rights purchase process. He/she will review the purchase contracts and ensure that the contract contains special conditions to protect your interests.

During the due diligence process your Solicitor will conduct a comprehensive legal due diligence review of the business including:

- The Caretaking and Letting Agreements

- The development plan and By-Laws

- A Body Corporate records search

Your Solicitor will liaise with all parties associated with the purchase process and will ensure that the various requirements of the Contract are achieved by the specified dates and will liaise with the Seller’s solicitor to arrange contemporaneous (simultaneous) settlement (completion) of the business and real estate contracts.

He/she will also liaise with the Body Corporate’s solicitor in relation to the preparation of the Deed of Assignment assigning the existing Caretaking and Letting Agreements over to you.

Step Six - Finance Approval

Having taken advantage of a complimentary interview with your Management Rights financier early in your decision making process will mean that you are better positioned to understand the finance approval process. On average you can expect to be required to contribute approximately 30% of the total purchase price yourself. Your financier’s lending guideline of 70% of total purchase price includes provision for an additional 5% of the purchase price being required for bank fees, stamp duty, government registration fees and due diligence costs.

By liaising with a lending institution that specialises in Management Rights, you will be assisted by a highly qualified team dedicated to providing flexible financial solutions to the industry. It is absolutely essential that you obtain an appropriate, competitive finance package that is tailored to your individual circumstances.

When approving your finance the bank will require verification of the business net profit for the period nominated on your Contract and will require a business valuation if the purchase price of the business is $1,000,000 or more.

Your lender will also be able to explain the various business services they provide to Management Rights owners including the establishment of trust accounts and provision for electronic disbursement of owners’ rental income.

Step Seven - Meeting the Body Corporate:

The Seller may choose to wait until the Contracts are unconditional before the request for this meeting is lodged. We would recommend that you discuss the timing of this interview with your agent to determine the best strategy particularly if you are wanting an early settlement or there are other influencing factors such as school holidays, when committee members may be away, or at Christmas when most legal and accounting firms close for a few weeks.

In the interview you will meet with members of the Body Corporate committee and the Body Corporate Manager. You will be asked a series of standard questions such as The Body Corporate Interview questions in the resource section of our website.

After which you may be asked to leave the interview room whilst the committee vote to approve the assignment. You will obtain written verification of this approval which must be forwarded to the Office of Fair Trading to finalise the licensing process.

Step Eight - Training and Technical Matters:

Your Contract will require the out-going Manager to provide business training for you, usually a week before and a week after settlement. It is your opportunity to gain understanding of the existing business systems and the day-to-day running of the complex. Many external organisations such as trust accounting software providers will also provide specialist training and it may be advisable to seek the advice of an IT technician to ensure the computer and associated software will meet your requirements.

During the training period it is essential that all documentation advising of the change of ownership of the business is completed. Your phone and internet systems should be transferred on day one of business operation and equipment leases and service provider accounts established.

It is sometimes a reality that, once the business changes hands, the Seller is keen to move on with little regard for adequate training. If this situation occurs the team at CBMR will willingly offer assistance with any ‘teething problems” that occur.

Step Nine - Settlement:

This is the big day! Your Solicitor will advise the designated time for Settlement and, once the Seller has been paid, you will receive keys and become the proud new owners of the Management Rights business. It’s time to move in and start the real work!